Americans gave an estimated $592.5 billion to charity in 2024—up 6.3% year-over-year and the first time total giving out-paced inflation since the pandemic years givingusa.org. Yet donors increasingly begin their journey online: over half of donors worldwide now prefer to give digitally Nonprofits Source, and Google searches for holiday giving terms spike every December, right when most nonprofits make or break their annual goals Amp Agency.

To capture that intent—and turn it into dollars—your organization needs a search-led content strategy built around high-yield keywords such as “charity donation tax deduction” or “charitable donation near me.” Below is an updated, research-driven framework you can copy today.

1 | Understand How (and When) People Search for Donations

| Keyword Cluster | Peak Season | Typical Intent | Why It Matters |

|---|---|---|---|

| Tax-related (“charity donation tax deduction,” “charitable donation deadline”) | Jan ▶ Apr 15 & Nov ▶ Dec 31 | Learn rules, claim deductions | 60 %-of-AGI cash cap; donors act before filing deadlines Internal Revenue Service |

| Location-based (“charitable donation near me,” “donation pick-up furniture”) | Year-round, surges in December | Find the closest drop-off or pick-up | Google’s “near me” queries grow double-digits each holiday season Amp Agency |

| Asset-based (“donate appreciated stock,” “donate vehicle”) | Q4, market highs | Maximize tax benefit, off-load assets | Gifting stock avoids capital-gains and is deductible at FMV up to 30 % AGI Internal Revenue Service |

| Online / Forms (“charity donation online,” “donation form”) | Constant | Complete a gift quickly | 49 % of church givers now donate with a card; online UX is mission-critical Nonprofits Source |

| Seasonal / Gift (“charity donation for Christmas,” “donation as gift”) | Nov ▶ Dec | Give in someone’s honor | Branded e-cards and bundles boost average gift size |

| Discovery / Lists (“charity donation list”) | Q1 planning & Q4 gift research | Compare options | Opportunity to showcase programs and targeted donor segments |

2 | Build a Keyword-Optimized Website Architecture

-

Landing Pages for Each Cluster

Example: “/donate/stock” optimized for charitable donation of appreciated stock with FAQs on 30 % AGI limits and automatic cost-basis receipts. -

Local Donation Center Hubs

– Create city sub-folders (“/drop-off/atlanta”) with driving directions, schema-marked opening hours, and CTAs for free furniture pick-up. -

Seasonal Microsites

– Launch a “Give Christmas Gifts” page by Oct 15 and update meta tags weekly as search volume rises. -

Tax Resource Center

– Offer a plain-English guide to IRS rules, embed Form 8283 download links, and a banner reminding supporters that cash gifts up to 60 % AGI are deductible Internal Revenue Service. -

Smart Internal Linking

– From every blog post, link back to the main online donation form; from tax pages, link to your nearest drop-off center to capture non-cash donors.

3 | Highlight Tax Benefits Clearly (and Accurately)

-

Current rules (2025): Cash gifts to public charities are deductible up to 60 % of AGI; property gifts generally up to 30 %. Anything above rolls forward five years Internal Revenue Service.

-

Coming in 2026: The recently-passed “One Big Beautiful Bill Act” will add an “above-the-line” $1,000 deduction for cash donations—even for non-itemizers—while capping high-earner itemized deductions MarketWatch. Educate both small and major donors now so they can time (or bunch) their gifts strategically.

4 | Leverage Email & Conversion Funnels

Email still drives 11 % of total online revenue, but nonprofits saw an 11 % drop in email revenue last year because volumes rose faster than engagement M+R Benchmarks 2025. Counteract that by:

-

Segmenting by keyword intent (“tax deduction” researchers vs. “near me” locals).

-

A/B testing subject lines that mirror top queries (“Claim Your 2025 Charitable Tax Deduction Tonight”).

-

Triggering automated reminder flows two weeks before the charitable donation deadline.

5 | Establish (or Promote) Local Donation Centers

Claim the Google Business Profile for each drop-off site—complete with high-resolution photos, ADA accessibility info, and “Book Pick-Up” links. Customers near your location will see you atop the map pack for “charitable donation near me.”

For bulky items, add a one-click scheduler for charity donation pick-up furniture requests. Highlight tax receipt delivery times to convert procrastinators.

6 | Amplify Reach with Data-Driven Outreach

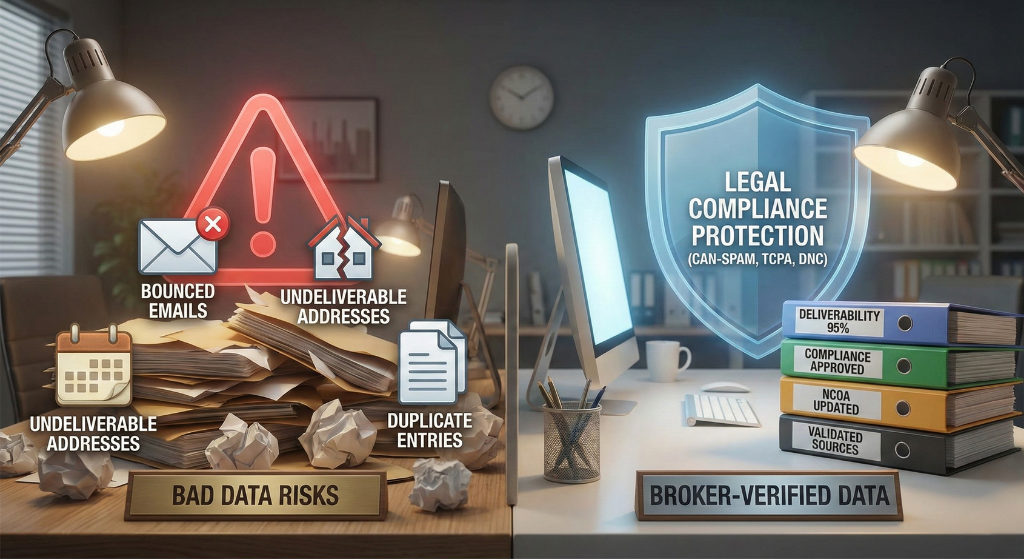

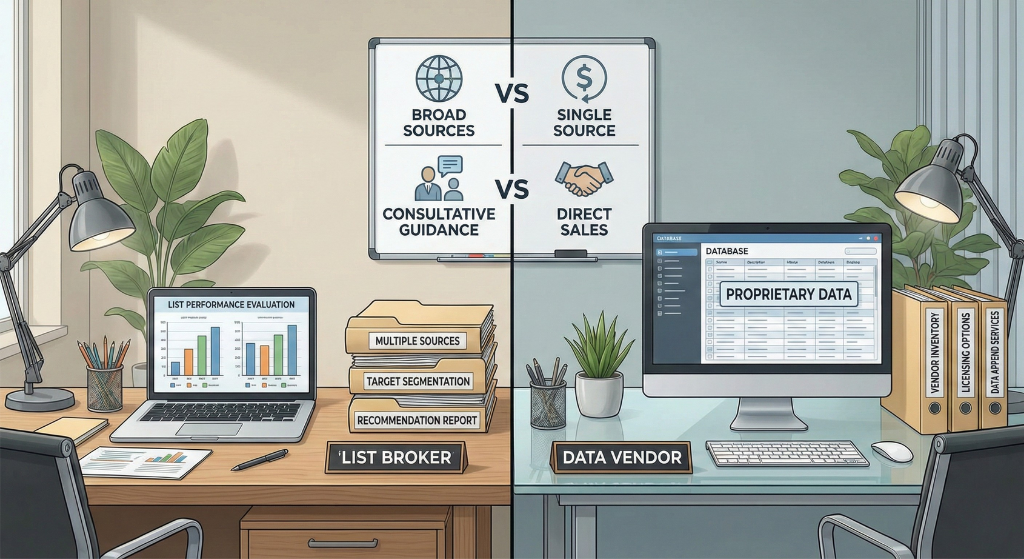

Once your organic funnel is humming, boost it with look-alike and email outreach to people already inclined to give. A cost-effective shortcut is tapping into high-value donor lists—curated databases of past charitable givers segmented by cause affinity and net worth. We partner with providers such as Prospects Influential; explore their targeted donor lists to jump-start your next acquisition campaign.

7 | Measure, Iterate, Repeat

-

Use Google Search Console to watch impressions for each cluster; set alerts when “donation tax deduction” clicks rise so you can add reminder pop-ups.

-

Track conversion lift from local pages (foot traffic, pick-ups) against organic-only benchmarks.

-

Re-run keyword research every quarter—especially after any IRS rule update—to catch emerging queries.

Key Takeaway

Donor behavior is increasingly digital, highly seasonal, and tax-savvy. By aligning your site structure and content with the exact phrases supporters use—from charity donation online in July to charitable donation deadline on December 30—you turn search intent into sustained, diversified revenue. Pair that SEO foundation with clear tax guidance, frictionless local options, and laser-focused outreach lists, and your nonprofit will be ready to meet (or beat) the record-setting generosity projected for 2025.