Direct marketing campaigns using purchased or rented lists expose organizations to substantial risks ranging from wasted budgets on bad data to severe legal penalties for compliance violations. These risks have intensified in 2026 as privacy regulations expand, enforcement increases, and data quality standards rise. Smart organizations recognize that working with experienced list brokers provides critical protection against these hazards.

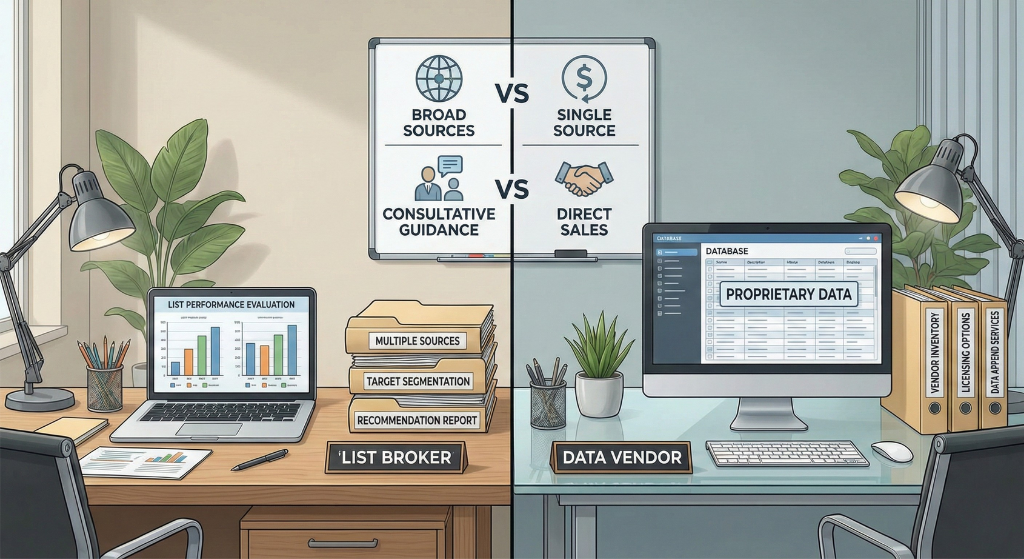

List brokers serve as risk management partners beyond just connecting clients with data sources. They vet data quality, ensure regulatory compliance, negotiate deliverability guarantees, prevent costly mistakes, and provide ongoing guidance as regulations evolve. The value of this protection often exceeds the cost of broker services many times over.

The Rising Cost of Bad Data in Direct Marketing

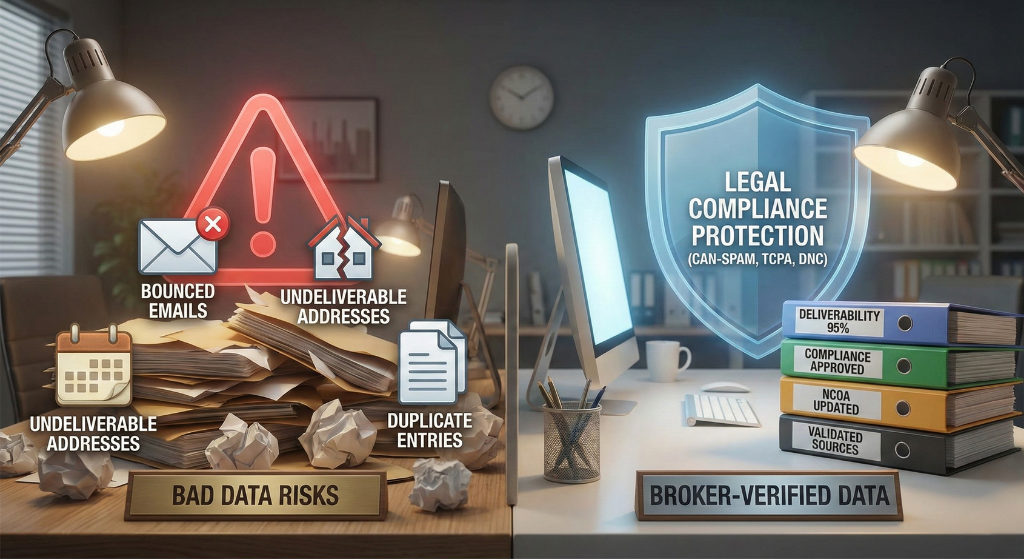

Poor quality list data wastes marketing budgets at alarming rates while damaging sender reputations.

Undeliverable addresses represent direct financial loss. When 20 to 30 percent of a mailing list contains outdated or incorrect addresses, those wasted pieces cost money with zero chance of response. On a 10,000-piece mailing at $1.00 per piece, 2,500 undeliverable addresses waste $2,500.

Bounce rates damage email sender reputation. Internet service providers track bounce rates as spam indicators. Email lists with 15 to 20 percent bounce rates trigger spam filtering that prevents future campaigns from reaching inboxes.

Deceased individuals on lists create insensitive situations. Mailing to deceased recipients offends surviving family members and damages brand reputation.

Duplicate records inflate costs unnecessarily. Lists without proper deduplication charge clients multiple times for the same person while annoying recipients receiving multiple copies.

Outdated demographic data creates targeting failures. Lists claiming to contain seniors ages 65-plus but actually including people who’ve aged into their 70s miss target audiences.

How List Brokers Vet Data Quality Before Recommendations

Experienced list brokers protect clients from bad data through rigorous source evaluation.

Deliverability guarantees verification ensures accountability. Reputable brokers only recommend list sources guaranteeing 90 to 95 percent deliverability and replacing undeliverable records. This transfers risk from clients to list owners.

Update frequency assessment reveals data freshness. Brokers ask list owners when databases were last updated and require monthly or quarterly updates. They reject sources with annual or older update cycles.

Source transparency investigation uncovers compilation methods. Quality brokers understand how lists are built. Self-reported survey data tends to be more accurate than modeled information.

Historical performance tracking from previous client campaigns provides actual quality data. Brokers who’ve placed hundreds of orders with specific sources know which consistently deliver quality.

NCOA processing verification confirms address updating. National Change of Address processing catches people who’ve moved. Brokers ensure lists undergo regular NCOA updates maintaining accuracy.

Compliance Protection in Complex Regulatory Landscape

Legal requirements around list usage have become labyrinthine. List brokers navigate this complexity professionally.

CAN-SPAM Act compliance for email campaigns requires specific elements. Every commercial email needs accurate header information, clear subject lines, valid physical address, and functional unsubscribe mechanism honored within 10 business days. Brokers ensure email lists meet these requirements.

Violations trigger penalties up to $51,744 per email. A single campaign violating CAN-SPAM across 10,000 recipients creates theoretical exposure exceeding $500 million. Even reduced enforcement penalties devastate organizations.

TCPA regulations around telemarketing create severe exposure. Calling mobile phones without prior express written consent using automated systems risks $500 to $1,500 per call. A 1,000-person calling campaign could cost $500,000 to $1.5 million in potential fines.

List brokers specializing in telemarketing lists understand consent documentation requirements. They help clients obtain lists where recipients provided proper consent or ensure campaigns only call landline numbers after Do Not Call Registry scrubbing.

Do Not Call Registry compliance requires monthly updates. The national registry must be downloaded at least every 31 days with listed numbers removed. Brokers coordinate this scrubbing or work with vendors ensuring compliance.

State-level telemarketing laws add complexity. Some states require registration before calling their residents. Others maintain state-specific do-not-call registries. Brokers familiar with these variations help clients maintain compliance.

Charitable solicitation laws affect nonprofits using lists for fundraising. Most states require registration before soliciting donations. Requirements vary dramatically. Brokers experienced in nonprofit list marketing guide organizations through this maze.

CCPA and state privacy laws create new requirements. California Consumer Privacy Act and similar state laws give consumers rights around their data. Lists must accommodate these rights.

How Brokers Protect Against List Fraud and Misrepresentation

The list industry contains disreputable actors. Brokers protect clients from scams and false claims.

Inflated count verification prevents paying for nonexistent records. Some unscrupulous list owners claim larger databases than actually exist. Brokers verify counts before clients commit.

Fabricated demographic claims get challenged through broker expertise. A list claiming 100,000 Jewish households in Wyoming should raise red flags. Brokers spot implausible claims novices might accept.

Recycled prospect data sold as fresh lists wastes money. Some vendors repackage old data as new compilations. Brokers recognize recycled lists through source investigation.

Licensing term enforcement protects client investments. One-time usage agreements should prevent list owners from charging again for authorized names. Brokers ensure proper suppression.

Strategic Risk Reduction Through Testing Guidance

Poor testing strategies waste enormous budgets. Brokers structure tests minimizing financial exposure while maximizing learning.

Right-sizing test quantities balances statistical validity with risk containment. Testing 500 names provides insufficient data. Testing 25,000 names exposes too much capital. Brokers typically recommend 3,000 to 5,000 per test segment.

Multi-segment testing reveals performance variations before scaling. Rather than betting entire budgets on single sources, brokers recommend testing 3 to 5 different segments.

Tracking mechanism implementation ensures attribution accuracy. Unique phone numbers, reply codes, and URLs for each test segment definitively show which lists generated responses.

Statistical significance thresholds prevent premature conclusions. Brokers help clients understand when performance differences are meaningful versus random variation.

Budget Protection Through Realistic Expectations

Misaligned expectations waste money on doomed campaigns. Brokers set realistic projections.

Response rate benchmarking prevents impossible assumptions. First-time direct mail to consumer lists typically generates 1.5 to 3 percent response. Planning budgets assuming 10 percent response creates failure.

Cost per acquisition calculations guide budget allocation. If customer lifetime value is $200, spending $150 to acquire customers leaves only $50 margin.

List rental costs versus total campaign costs get properly proportioned. List rental might be $200 per thousand while creative, printing, and postage add $800 per thousand.

Volume requirement planning matches lists to campaign needs. If campaigns require 100,000 names but recommended lists contain only 15,000 each, clients need multiple sources.

Ongoing Compliance Monitoring as Regulations Evolve

Regulations don’t stay static. Brokers track changes affecting client campaigns.

FTC rule updates get communicated promptly. When Federal Trade Commission modifies telemarketing rules or email regulations, brokers inform clients of changes.

State law changes require monitoring across 50 jurisdictions. New state privacy laws, charitable solicitation requirements, and telemarketing rules emerge regularly.

Industry best practice evolution guides recommendations. As direct marketing industry standards rise, brokers adjust their quality thresholds accordingly.

Court decisions affecting list usage get analyzed for client impact. Legal precedents around TCPA, CAN-SPAM, and privacy laws influence compliance strategies.

Multi-Channel Risk Management

Multi-channel campaigns combining direct mail, email, and phone create compound compliance requirements.

Channel-specific regulations apply simultaneously. A campaign using the same list for mail, email, and calls must comply with postal regulations, CAN-SPAM, TCPA, and Do Not Call rules.

Data append compliance affects multi-channel campaigns. Adding email addresses or phone numbers to mailing lists requires following rules governing each channel.

Suppression file coordination prevents channel conflicts. Someone unsubscribing from email shouldn’t receive phone calls. Brokers help clients maintain cross-channel suppression.

Vendor Relationship Management Reduces Risk

Broker relationships with list owners provide clients protection individual companies cannot achieve.

Problem resolution leverage gets clients results. When list quality disappoints, brokers advocate for clients using relationships and aggregate volume as leverage.

Guarantee enforcement happens through broker pressure. List owners honor deliverability guarantees more readily when brokers representing multiple clients demand compliance.

Quality escalation to list owners improves performance. Brokers reporting systematic quality issues drive improvements benefiting all clients.

Industry Expertise Prevents Novice Mistakes

Experience matters enormously in risk reduction.

First-time campaign guidance prevents costly errors. Organizations new to direct marketing make predictable mistakes around timing, creative, offers, and lists.

Specialty list knowledge identifies appropriate sources. Targeting niche markets requires knowing obscure sources.

Industry-specific compliance nuances get addressed. Healthcare, financial services, and political marketing face unique regulations.

Measuring the ROI of Broker Risk Reduction

The value of broker risk management becomes clear through cost comparisons.

Single compliance violation prevented pays for years of broker services. A $50,000 TCPA penalty avoided through broker guidance justifies substantial broker fees across multiple campaigns.

Improved data quality drives measurable performance gains. If broker-sourced lists deliver 3 percent response versus 1.5 percent from poorly-vetted sources, the improved ROI massively outweighs broker costs.

Avoided campaign failures save entire budget investments. Testing showing poor list performance before $100,000 rollout saves that investment even if testing costs $10,000 including broker fees.

In 2026’s complex regulatory environment with evolving privacy laws, rising data quality expectations, and severe penalties for violations, working with experienced list brokers has shifted from optional to essential.

The risks of bad data, compliance violations, list fraud, and strategic mistakes have grown while broker expertise in managing these dangers has become more sophisticated.

Ready to protect your organization from list-related risks? Work with experienced list brokers at Prospects Influential who provide comprehensive risk management across consumer lists, business lists, and specialty lists.