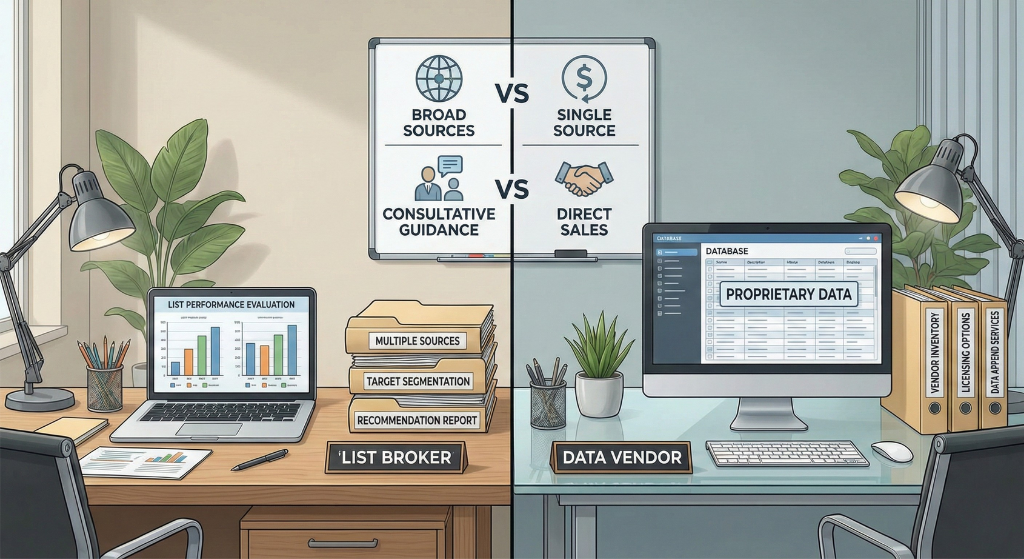

Companies launching direct marketing campaigns face a critical decision: should they work with list brokers or buy data directly from data vendors? While these terms are often used interchangeably, they represent fundamentally different business models with distinct advantages and appropriate use cases. Understanding these differences helps organizations choose the right approach for their specific campaign needs.

The confusion stems from both serving the broader data marketplace. However, list brokers act as consultative intermediaries representing client interests across multiple data sources, while data vendors sell their own proprietary databases directly to end users. This fundamental distinction creates dramatically different service models, pricing structures, and value propositions.

What List Brokers Actually Are and How They Operate

List brokers serve as independent intermediaries connecting companies that need marketing lists with the hundreds or thousands of list owners who rent their databases.

The broker business model centers on client representation rather than list ownership. Brokers don’t own the lists they recommend. Instead, they maintain relationships with numerous list owners, managers, and compilers, providing clients access to comprehensive inventory across multiple sources.

Consultative approach defines the broker relationship. When clients describe their ideal prospects, list brokers recommend optimal lists from their entire universe of available sources. They evaluate options objectively based on client campaign goals rather than pushing specific inventory.

Commission-based or fee-based compensation aligns broker incentives with client success. Most brokers earn commissions from list owners when clients rent lists. This means brokers succeed when campaigns work well and clients continue using their services.

Multi-source access provides competitive advantage. A quality broker might have relationships with 500 to 1,000 different list sources spanning consumer lists, business lists, and specialty lists.

Campaign optimization expertise extends beyond just list selection. Experienced brokers provide strategic consultation on targeting, creative, timing, testing, and multi-channel integration.

What Data Vendors Are and How They Differ

Data vendors operate as list owners who compile, maintain, and sell access to their own proprietary databases.

Direct ownership model means vendors control their data assets. They invest in compiling consumer or business information from public records, surveys, and transaction data. This data becomes their product to license or sell.

Sales-driven approach focuses on moving vendor inventory. While good vendors want satisfied customers, their primary objective is selling access to the specific databases they own rather than recommending competitors’ potentially superior options.

Pricing structures often favor volume and exclusivity. Vendors may offer lower per-thousand costs for large orders, multi-year agreements, or exclusive usage rights.

Limited inventory by definition constrains vendor recommendations. Even the largest data vendors own just a fraction of all available marketing lists.

Technical expertise in data compilation and enhancement represents core vendor competency. They invest in sophisticated matching algorithms, append services, and data hygiene.

Ownership or unlimited usage options exist with some vendors. Unlike rental-only broker models, some data vendors sell databases outright or license unlimited usage for flat fees.

Key Differences in Service and Value Proposition

The broker versus vendor distinction creates practical differences affecting campaign outcomes.

Breadth of available options separates brokers from vendors dramatically. A broker might provide access to 100 different senior citizen lists from various sources. A data vendor offers only their proprietary senior database regardless of whether it’s optimal.

Objectivity in recommendations favors brokers. When evaluating whether List A or List B better matches campaign needs, brokers recommend whichever performs better. Vendors recommend their list even when competitors might work better.

Strategic consultation depth tends to be stronger with brokers who’ve helped clients across multiple campaigns. Vendors focus primarily on their own data rather than broader campaign strategy.

Pricing negotiations leverage differs. Brokers aggregating demand across clients often secure volume discounts individual companies can’t obtain. However, vendors selling direct eliminate broker commissions potentially offsetting this advantage.

Compliance guidance comprehensiveness benefits from broker experience across numerous data sources and regulations. Vendors understand compliance for their data but may lack broader regulatory expertise.

When List Brokers Make the Most Sense

Certain situations clearly favor working with list brokers over direct vendor relationships.

New to direct marketing organizations benefit enormously from broker expertise. Companies launching first campaigns lack internal knowledge to evaluate data sources effectively. Brokers provide education and guidance preventing costly mistakes.

Campaign complexity requiring multiple list sources necessitates broker coordination. When targeting requires combining senior lists, geographic selects, and donor history from multiple sources, brokers handle complexity vendors cannot.

Testing and optimization priorities favor broker objectivity. Organizations wanting to test multiple list sources to identify top performers need brokers who can coordinate tests across competing vendors.

Niche targeting requiring specialized lists works well with brokers maintaining relationships across obscure sources. Finding Christian homeschoolers or high-net-worth boat owners requires broker market knowledge.

Budget constraints benefiting from broker negotiating leverage help stretch limited resources. Brokers obtaining volume discounts and waived minimums save clients money.

Compliance concerns in regulated industries benefit from broker expertise. Healthcare, financial services, and nonprofit fundraising face complex regulations.

Multi-channel campaigns coordinating direct mail, email, and telemarketing require broker expertise integrating different data types.

When Data Vendors Might Be Better Choices

Despite broker advantages, some scenarios favor direct vendor relationships.

High-volume ongoing campaigns using single proven source benefit from direct vendor relationships. If testing identifies one vendor’s database as clearly superior and campaigns require millions of names annually, negotiating direct deals makes sense.

Unlimited usage needs fit vendor licensing models better. Brokers facilitating one-time rentals can’t match vendor offers to license databases for unlimited internal use.

Proprietary data enhancement requirements may require vendor relationships. Companies needing specific append services or modeling available only from particular vendors must work direct.

Budget predictability through flat-fee annual licenses appeals to some organizations. Rather than variable per-campaign list costs, annual vendor licenses create predictable expenses.

Internal data science teams capable of evaluating sources independently may not need broker consultation. Large corporations with sophisticated analytics groups can assess vendors directly.

The Hybrid Approach: Using Both Strategically

Many sophisticated marketers combine broker and vendor relationships strategically.

Primary list sources through vendors provide core proven inventory. After testing identifies top-performing databases, companies negotiate direct vendor relationships for these core lists used repeatedly.

Broker relationships for new sources and testing continue alongside vendor agreements. Brokers help identify additional sources, test new segments, and optimize beyond core vendor lists.

Multi-channel campaigns benefit from broker coordination even when some core data comes from direct vendor relationships.

Compliance consulting from brokers protects even when using vendor data. Brokers provide regulatory guidance beyond what vendors offer.

Cost Comparison: Broker Fees vs Direct Vendor Savings

Understanding true costs requires looking beyond simple per-thousand pricing.

Broker commission or fees typically add 10 to 20 percent to list costs compared to hypothetical direct pricing. A $100 per thousand list might cost $110 to $120 when rented through a broker.

However, broker negotiating power often eliminates this premium. Volume discounts, waived minimums, and multi-use arrangements negotiated by brokers frequently offset commissions entirely.

Testing efficiency prevents larger wastes. Broker-guided testing spending $5,000 to identify optimal lists before $50,000 rollout saves far more than broker fees cost.

Campaign performance improvements from better targeting dwarf fee differences. If broker expertise increases response rate from 2 to 3 percent, the improved ROI justifies any fee structure.

Compliance violation avoidance represents massive cost savings. A single TCPA violation costs $500 to $1,500. Broker compliance guidance preventing violations saves exponentially more than fees cost.

Evaluating Data Quality Across Models

Data quality varies within both broker-sourced and vendor-direct models.

Vendor quality depends entirely on specific vendor chosen. Top-tier data compilers maintain excellent quality through rigorous processes. Low-quality vendors cut corners.

Broker-sourced quality depends on broker vetting. Reputable brokers recommend only verified high-quality sources. They check deliverability guarantees, update frequency, and source transparency.

Testing remains essential regardless of model. Neither broker reputation nor vendor claims substitute for actual campaign testing.

Deliverability guarantees provide important protection. Whether through brokers or direct, ensure vendors guarantee 90 to 95 percent deliverability.

Update frequency affects list performance dramatically. Monthly updates maintain quality. Annual updates produce unacceptably high undeliverable rates.

Questions to Ask When Choosing Between Models

Systematic evaluation prevents costly mistakes.

What’s your experience level with direct marketing? Novices benefit from brokers. Experts might manage vendor relationships directly.

How many different list sources will campaigns require? Multiple sources favor brokers. Single source might work direct.

Do you need strategic consultation beyond just data access? Campaign strategy needs favor brokers.

What’s your testing and optimization approach? Rigorous testing across sources requires brokers.

How important is compliance expertise for your industry? Regulated industries benefit from broker compliance guidance.

The Future of Both Models in 2026

Both brokers and vendors continue evolving to meet changing market needs.

Privacy regulations increase value of both broker compliance expertise and vendor data governance. GDPR, CCPA, and emerging state laws make both professional guidance and vendor practices more critical.

Channel proliferation benefits brokers who coordinate across direct mail, email, social media, and programmatic advertising. Vendors focusing on single data types struggle with omnichannel complexity.

Data quality standards rising across industry push both brokers and vendors toward higher standards.

The choice between list brokers and data vendors depends on campaign complexity, internal expertise, testing requirements, compliance needs, and volume considerations. Most organizations benefit from broker relationships providing access to comprehensive inventory, objective recommendations, strategic consultation, and compliance protection.

However, high-volume users of proven sources may find value in direct vendor relationships after broker-guided testing identifies optimal databases.

Ready to determine whether list brokers or data vendors best serve your needs? Contact experienced list brokers at Prospects Influential who can evaluate your specific situation and recommend optimal approaches across consumer lists, business lists, and specialty lists.